.jpg)

Investors often fret: “Is now really a good time to buy?”, “Should I wait for a dip?”, or “Did I just buy the top?”.

Naturally, buying stocks at all-time highs can feel like a gamble. Many imagine that new peaks are the cliff’s edge before a fall. Yet the reality is far more mundane: highs are normal. In fact, they’re a sign of a healthy market that, over decades, tends to grind higher. History shows that whether you invest at the month’s high or the month’s low, the difference to your long-term returns are barely noticeable.

BlackRock examined the S&P 500 from 1957 and found that returns following a new all-time high were virtually indistinguishable from returns at any other time. Put another way: markets keep making new highs because they keep growing over time. RBC Global Asset Management did a similar study, examining every all-time high since 1950. One year later, the market was rarely down more than 10%. Ten years later? It was never down more than 10%.

The lesson is clear: even “bad timing” at a high point hasn’t doomed long-term investors.

More Proof That “High Isn’t Harm” Trends Hold

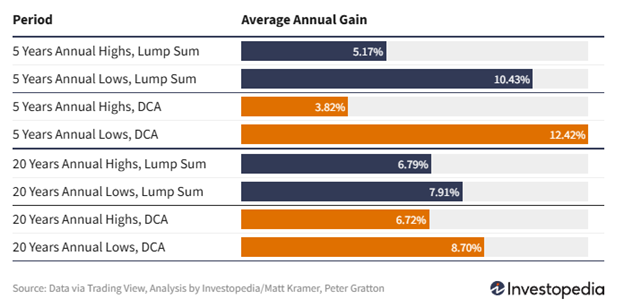

It’s not just one or two studies — the evidence is consistent across geographies and time periods. Schroders found that investing at all-time highs actually delivered better forward returns on average than investing at random times. Investopedia tested the so-called “Costanza Strategy” — always buying at the worst possible time, the annual high. Even then, 20-year annualized returns were 6.72%, only slightly behind the 8.7% achieved by perfect market timing.

The real driver of retirement success isn’t timing — it’s compounding: your returns earning returns on top of returns— and the length of time you stay invested.

Why Timing Fails, and Time Wins

Why don’t highs spell disaster? Because markets are forward-looking. When stocks are hitting new highs, it often means businesses are growing, earnings are strong, and momentum is positive. Highs tend to cluster during uptrends — not just before collapses.

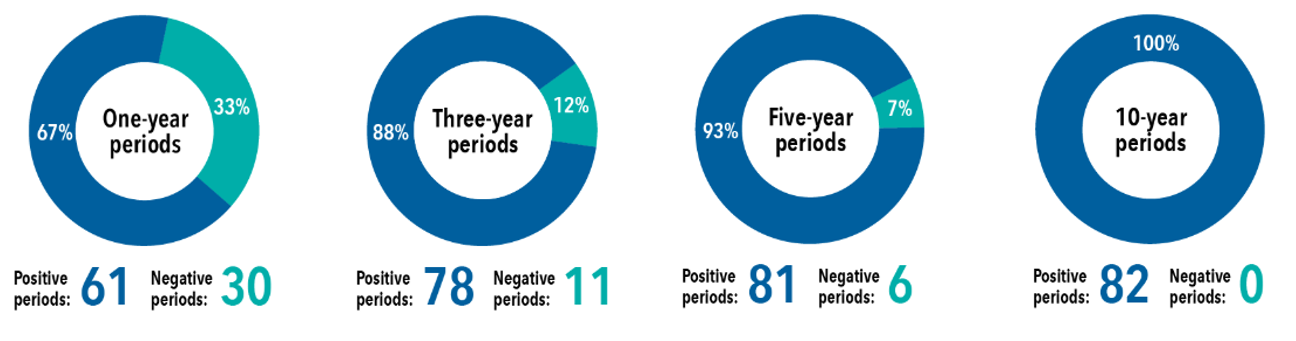

Charles Schwab tested five strategies: perfect timing, worst timing, dollar-cost averaging, investing immediately, and never investing. Over 20 years, the difference between perfect timing and just investing right away was surprisingly small. The real penalty came from not investing at all. Similarly, Capital Group showed that across all rolling 10-year periods, the S&P 500 delivered positive returns 100% of the time. That’s the power of compounding: the longer you stay invested, the less your entry point matters.

The Takeaway

If you have cash to put to work, the data is overwhelming: don’t wait for the perfect moment. Perfect moments don’t exist — and waiting usually costs more than simply getting invested. Every study says the same thing: the market rewards time, not precision.

The real drivers of your success aren’t whether you bought at a high or a low — they’re your asset allocation, your costs, your behaviour, and, above all, your time horizon. Markets will rise, fall, and rise again. If you let short-term noise dictate your long-term strategy, you risk missing the very compounding that builds wealth.

“The stock market is designed to transfer money from the Active to the Patient.” – Warren Buffett.

Put the odds in your favour. Build a portfolio that can weather storms, keep your costs low, and give your investments the one ingredient they truly need: time. Because in investing, as in life, patience doesn’t just pay — it compounds.